The European Central Bank’s digital euro, as outlined in a recent report by the German Ministry of the Interior, will possess a distinct characteristic – programmability. This means that the digital euro will be designated for specific purposes, restricting its owner from unrestricted disposal.

In essence, it becomes money that is not entirely under the control of its owner.

Your payments will based on how good you are behaving according to no metrics. Remember that illegal content is a subjective concept, yes of course, there is content that for real deserves to be down from the internet and authorities have the obligation to follow the case, and stop monetization from illegal activities; but no government has the right to check in every person private life to find out if they deserve their salary this month and in what they can expend it.

The implementation of this technological restrictions is lead by REWE Group, that has introduced the country’s first fully automated supermarket, featuring an exciting concept called “Pick and Go” in Munich, Bavaria. The customers can simply walk into the store, pick the items they need from the shelves, and leave without having to go through the traditional checkout process. Unlike self-checkout options that involve scanning items individually, here shoppers only need to scan their phones once upon entering the store. When they exit, the system automatically generates their receipt.

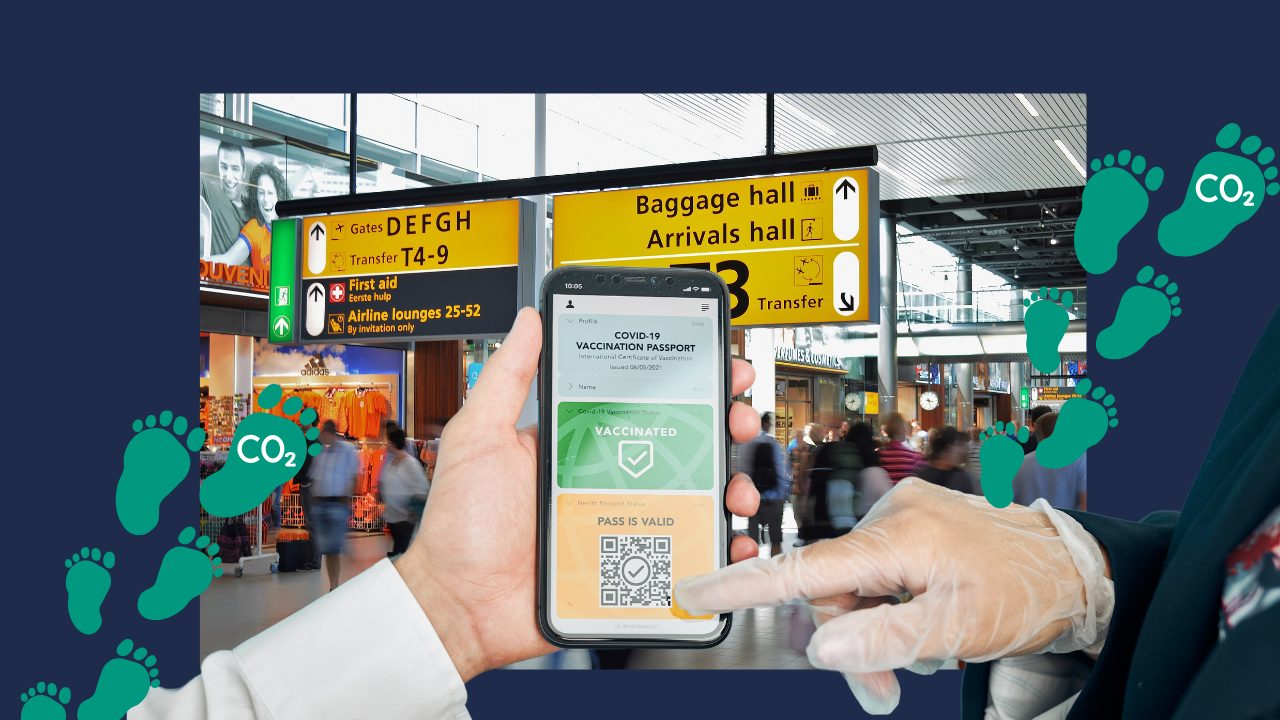

Using technology like facial recognition and NFC chips governments and companies can work together to collect, control and expend as much as our money.With the Digital Services Act, hand to hand with the CBDC, the European Union is seeking that each country has the rights to supervise and remove, according to the words: illegal content.

The circular monetary censorship allow companies to tell users if they remove their content, limit its visibility, or stop its monetization from digital platforms, another form of control.

Of course, this has been considered an evil conspiracy theory for years, and nobody intends to earmark money. Since the European Union express interest in creating the CBDCs, raised concerns in serious financial advisors and institutions like Waller 2021, Bofinger 2022, Financial Times 2023; The Economist 2023.

The Governing Council also decided to proceed with the “preparation phase” of the project. The preparation phase focuses on additional experiments, selecting service providers, prototyping, and aligning with the ongoing efforts of relevant European co-legislators preparing the legal framework for a digital euro.

The first pilot in Germany has just been pushed through: With the “payment card” for migrants, the blueprint has been created and this taboo has already been broken – TKP has reported. The document from the Federal Office for Security and Information Technology is unambiguous. Accordingly, what the payment card is only for migrants could become digital money for everyone.

Even Banks are worried about this plan: Many banks worry their customers might withdraw deposits to hold digital euro instead. These fears are misplaced: a digital euro will be designed as a means of payment and not for investment, argue ECB Executive Board member Piero Cipollone, Ulrich Bindseil and Jürgen Schaaf.

In the chapter “Overarching functionality” on page 11, the Federal Office writes (emphasis TKP):

The requirements contained in this document relate to the core system of the CBDC backend, which forms the technical backbone for the use of CBDC notes. When implemented in practice, the CBDC ecosystem may contain further functions and offer further services that are based on the core system as an additional application layer.

This may include, for example, support for automatically triggering payments when predefined conditions are met (often referred to as programmability) or prohibiting payments when a wallet issued for specific purposes only is used outside its authorized range.

The vision for the digital euro encompasses its transferability both online and offline, using a variety of means including payment cards, mobile phones, electronic wallets in hardware or software form, as well as traditional bank accounts. It’s important to note that the central bank, in this case the ECB, would always have control over the issuance and retrieval of the digital currency. Page 10 explicitly states:

“The central bank has the authority to revoke CBDC notes, for instance, as a means to control the money supply. The revocation process is carried out by an authorized body, known as the revocation authority, which is overseen and operated by the central bank.”

In the event that the digital euro is not spent in accordance with the desired guidelines, there is a possibility that it could be withdrawn. This implies that traditional forms of saving, as currently practiced, may not be feasible with the digital euro. It’s important to acknowledge that there could be limitations on the amount of digital euro holdings for individuals in the general population.

Welcome the era of privacy in payments!

Digital anonymous payments are revolutionizing the way we transact and provide a secure safeguard for your financial activities.

I’m not talking about central bank controlled CBDCs!

Find out how to make truly anonymous payments – whether for discreet purchases or to protect your data – in the new blog post.

Also, the physical space where to use it could be a source on control from Europe to another nations, if you are person earning in euro but living in countries where the European Union has economical restrictions, or non agreements you might have problems using digital euros even coming from your own salary. This could be one of the articles they quote to hold your account, according to the Third Payment Services Directive (PSD3).

“The provision of digital euro services by PSPs would be limited, however, to natural or legal persons residing or established in:

(i) a member state whose currency is the euro;

(ii) a member state whose currency is not the euro, subject to an agreement entered into between the ECB and the national central bank of that member state; or

(iii) a third country, if the EU and that third country conclude an international agreement and the ECB and the non-EU national central bank enter into an arrangement specifying the necessary implementing measures.

Even merchants would be able to receive and process digital euro, but not hold them.

Moreover, digital euro holdings would not accrue interest. Last but not least, users would be able to seamlessly link their digital euro account to a payment account with their bank, enabling a ‘reverse waterfall’ mechanism. This eliminates the need to pre-fund the digital euro account for online payments, as any shortfall would be covered instantly from the linked commercial bank account, provided it has sufficient funds available.

Quite dystopian:, page 12 theorizes about the “use of different types of wallets” (meaning an app): each “wallet” would have a “different functionality”.

Depending on the amount of personal information they require, wallets may only allow payments only with certain restrictions (e.g. amount of money stored, number of payments per day, amount of money per transaction or per day) or without such restrictions (apart from general restrictions, if the central bank deems it appropriate to impose them).

This approach can give rise to (at least) two types of wallets: Fully anonymous wallets, which require no personal information and are subject to restrictions, and personalized wallets, which are fully traceable but not subject to restrictions. However, on page 83, the question of whether anonymous payments will still be possible under CBDC is answer: “Depends on implementation. Can be provided up to a certain amount of money if the associated risk of fraud is accepted.”

The European Central Bank’s proposal for a digital euro raises concerns among data protection authorities

European Union Data Protection Bodies (EDPB) have called on the European Central Bank (ECB) to clarify some aspects of its proposal for a digital euro and strongly recommend that digital users always have the choice to pay in digital euros or in cash, as well as that the digital euro would not be “programmable money”.

If the digital euro is designed to act as the next level in the development of cash as a means of payment – stepping in to compensate for the declining role of paper money; the decision to exclude merchants (and any other firms) from storing digital euro and to require them to transfer any digital euro position instantly to their bank account will help to create a parallel economy based on cryptocurrencies, cash from the black market and the trade of goods and services like in the old times.

Meanwhile, the automobile industry is moving away from Germany and banks like Deutsche Pfandbriefbank (PBBG.DE) are experiencing a decline in its shares and a drop in the price of its debt following a credit rating downgrade by S&P, and not in a very good moment to bother farmers about a new implementation of digital payments.