In the last few years, the art world has witnessed an unprecedented transformation, thanks to the rise of Non-Fungible Tokens (NFTs). These digital assets, which utilize blockchain technology to certify ownership and authenticity, have not only reshaped the way we think about art and its distribution but have also opened new avenues for artists to monetize their work. Let’s dive into how NFTs are changing the art scene, highlighting real-life examples of artists who are successfully navigating this new digital frontier.

The traditional art scene, governed by prestigious galleries, influential institutions, and key curators, has long erected formidable barriers for artists aiming for recognition and visibility. This exclusive group of gatekeepers wields the authority to determine which pieces are showcased and acknowledged as genuine art. Such centralized control has consistently limited artists’ opportunities to access famous galleries and collectors, rendering success largely reliant on connections within established networks.

NFTs: A New Muse for Artists

“Amy Whitaker, who lectures on the economics of the art world at New York University, points out, ‘Art exists within a sphere where every decision is inherently political, especially regarding one’s stance towards economics.‘ The process of buying, selling, and admiring NFTs inherently brings to the forefront discussions on ownership and its implications. This includes the dynamics of generosity, as NFT images are meant to circulate freely, and greed, as they are often purchased to enrich those already wealthy from cryptocurrency.

Additionally, the creation of NFTs, which can be a collaborative effort, and the distribution of profits, which often benefits individuals, highlight issues of community versus individualism. With access and visibility in the hands of a few, attaining acknowledgment in the art world can be an overwhelming, often insurmountable challenge for numerous artists. Even for those who succeed in making a name for themselves, the financial benefits are generally linked to gallery sales, which means artists must navigate substantial commissions and endure lengthy waits for payment.

The inception of NFTs was primarily driven by a focus on sales, not aesthetics.

In 2014, during an art-a-thon at the New Museum in New York, which was known for its tech-savvy approach, the experienced digital artist Kevin McCoy and a technologist, Anil Dash, developed what is now considered the very first NFT, even though the term ‘NFT’ had not yet been coined.

However, this intertwining of art with social and economic themes is not new and has been a central element of fine art for decades, especially in its most innovative and provocative forms. Consider the ‘Business Art’ genre, which turns the cultural complexity of buying and selling into the art itself. This approach was initiated around 60 years ago by artists like Yves Klein, Andy Warhol, and 1960s conceptualists and gained momentum in the 1990s with artists like Damien Hirst.

NFTs started to gain a lot of traction in 2017 with a game called CryptoKitties in which users could adopt and trade virtual cats on the blockchain. CryptoKitties was so popular that, due to all of the trading, it even lagged the Ethereum blockchain. Seeing the success of CryptoKitties attracted investors from a16z and Google Ventures to enter the space. This represented a beginning in the NFT boom. There are now massive ecosystems for NFTs with hundreds of NFT projects as well as vibrant market places like OpenSea and SuperRare.

One of the most significant impacts of NFTs is their ability to empower artists. Traditional art markets can be exclusive, with high barriers to entry for emerging artists. NFTs, however, democratize the art scene by providing a platform for artists to directly reach their audience without the need for galleries or auction houses. This not only increases the visibility of artists but also allows them to retain a larger portion of their sales.

Case Studies

Damien Hirst ventured into the NFT space with ‘The Currency,’ becoming one of the first renowned artists to do so. His project involved offering NFTs corresponding to 10,000 of his Spot paintings, presenting collectors with a year to decide between retaining the blockchain token, leading to the physical canvas’s destruction, or keeping the canvas and forfeiting the NFT. This project, which grossed approximately $18 million in its initial sale and was produced with HENI, an art services company, represented Hirst’s exploration of the tension between market dynamics and the joy of aesthetics.

Beeple (Mike Winkelmann): Perhaps the most famous example is the artist known as Beeple, who sold an NFT of his work “Everydays: The First 5000 Days” for a staggering $69 million at Christie’s auction. This sale not only made headlines around the world but also marked one of the highest sales for any living artist. Beeple’s success is a testament to the potential financial rewards for artists in the NFT space.

Fewocious: Victor Langlois, known as Fewocious, is a young artist who transitioned from traditional painting to NFT art. By the age of 18, Fewocious had sold millions of dollars worth of digital art, illustrating the potential for NFTs to support emerging artists in achieving financial success and recognition at an early stage in their careers.

However, the reality for most artists engaging with NFTs isn’t as profitable as it might seem. Upon consulting Ethan McMahon, an economist at the analytics firm Chainalysis, to analyze some data, it became clear that around half of all NFT sales fetch less than $400. This amount scarcely covers the blockchain expenses involved in “minting” an NFT, not to mention the costs associated with running a digital studio. This figure doesn’t even account for the numerous NFTs that never find a buyer.

Some artists choose to distribute their creations at no cost, as a deliberate act of defiance against the capitalist inclination to commodify, while others attach unconventional stipulations to their works within the NFT realm. For example, a work by Danielle Brathwaite-Shirley, an artist from London, is a low-resolution GIF that displays a list of “Terms and Conditions.” These conditions must be complied with and fulfilled by the buyer.. Furthermore, in the legally binding agreement of the NFT, the collector consents to honor these commitments, which includes physically printing out these terms and visibly posting them for a duration of two years.

Many NFT marketplaces and platforms collect user data as part of their operations. The extent and nature of this data collection can vary, but it often includes transaction histories, wallet addresses, and sometimes more personal information. Users of these platforms should be aware of the privacy policies of the platforms they use and understand how their data is being collected, used, and potentially shared.

McMahon further noted that the significant profit from NFTs, particularly from resales, is concentrated at the higher end of the market. The reality is that the majority of NFTs are seldom resold. He warned those looking to capitalize on the NFT craze to tread cautiously, stating, “People who are trying to profit from the current NFT craze really need to be careful. A lot of times, it ends up working against you.”

While blockchain transactions are pseudonymous, they can often be traced back to real-world identities through wallet addresses, especially if a wallet is used for transactions that involve fiat currency exchanges. This traceability can expose collectors and artists to privacy risks, including unwanted attention or targeted attacks.

Challenges and Criticisms

Despite the exciting opportunities, the NFT art scene is not without its challenges and criticisms. Concerns over environmental impact, due to the energy-intensive nature of blockchain technology, and questions about the longevity and value retention of digital art, remain hotly debated topics. Furthermore, the volatility of the cryptocurrency market, which underpins the NFT ecosystem, adds a layer of financial risk for both artists and collectors.

The digital nature of NFTs and their reliance on blockchain technology expose them to cybersecurity risks. Phishing attacks, wallet thefts, and smart contract vulnerabilities can all lead to privacy breaches and financial loss. Ensuring the security of digital wallets and being cautious of scams are critical for maintaining privacy and protecting assets in the NFT space.

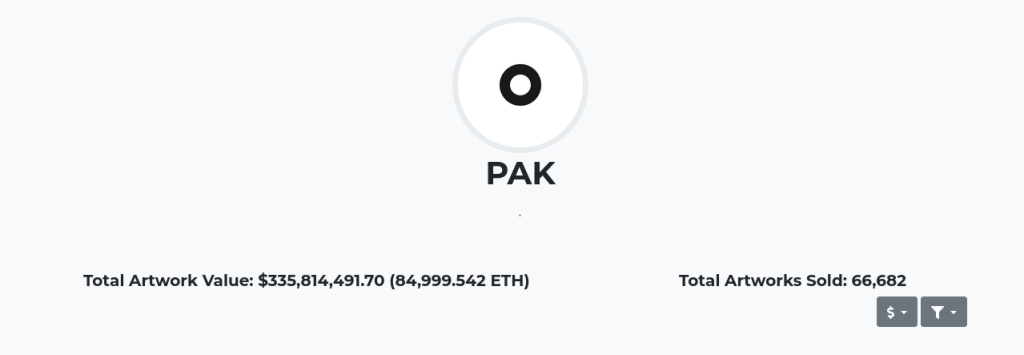

As the art world continues to evolve, NFTs are undeniably playing a pivotal role in shaping its future. They have introduced a new era of digital creativity, enabling artists to explore innovative forms of expression and connect with audiences on a global scale. Despite the challenges, the success stories of artists like Beeple, Pak, and Fewocious highlight the potential for NFTs to redefine the boundaries of art, creativity, and ownership in the digital age.

In conclusion, NFTs are more than just a fleeting trend; they are a transformative force in the art scene. By providing new ways for artists to monetize their work and engage with their audience, NFTs are carving out a new paradigm for what art can be in the 21st century. As technology continues to advance, it will be fascinating to see how NFTs further disrupt and enrich the art world, offering both opportunities and challenges along the way.

Welcome the era of privacy in payments!

Digital anonymous payments are revolutionizing the way we transact and provide a secure safeguard for your financial activities.

I’m not talking about central bank controlled CBDCs!

Find out how to make truly anonymous payments – whether for discreet purchases or to protect your data – in the new blog post.